World steel price rises

Global steel prices rise

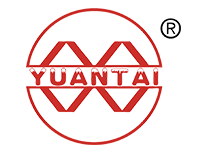

In February, the international steel market fluctuated and rose. During the reporting period, the Steel House Global Steel Benchmark Price Index at 141.4 points increased by 1.3% week-on-week (from a fall to an increase), rose by 1.6% month-on-month (the same as before), and fell by 18.4% month-on-month (the same as before). Among them: the flat material index was 136.5 points, up 2.2% week-on-week (increased increase); the long product index was 148.4 points, up 0.2% week-on-week (from fall to rise); the Asian index was 138.8 points, up 0.4% week-on-week (from fall to rise); rise). In Asia, China's index was 132.4 points, up 0.8% week-on-week (turning from down to up); America's index was 177.6 points, up 3.7% week-on-week (expansion); the European index was 134.5 points, up 0.8% week-on-week (from down to up ).

International steel prices resumed their upward trend after a brief correction, generally confirming the previous forecast. From a fundamental point of view, markets across the country are generally on the rise, giving the industry unfulfilled expectations. From the perspective of operating logic, the trend after the relay consolidation may be more aggressive. Especially under the "bitter" steel demand such as post-epidemic recovery, post-disaster reconstruction, and supply reduction, the market may go further, and staged highs may appear in the near future.

According to the forecast of the development trend combined with the fundamental situation, the international steel market may continue to fluctuate and rise in March. (See Figure 1)

Global steel production in the first month: decreased by 3.3%; Excluding Chinese Mainland, it dropped 9.3%. According to the data of the World Steel Association, in January 2023, the crude steel output of the 64 major countries and regions included in the statistics of the World Steel Association was 145 million tons, down 3.3% year on year, with a decrease of 4.95 million tons; The global (excluding Chinese Mainland) steel production reached 65.8 million tons, down 9.3% year on year, and the output decreased by 6.72 million tons.

ArcelorMittal plans to restart a blast furnace at the French steel plant. ArcelorMittal said that due to the continuous rebound in European plate prices and the improvement of the European automobile industry in the coming months, it was decided to restart the No. 2 blast furnace of the French Binhai Foss Steel Plant in April.

POSCO plans to build 2.5 million tons of electric furnaces. POSCO plans to invest 600 billion won to build a new electric furnace and supporting equipment with an annual output of 2.5 million tons of molten steel at its Guangyang Steel Plant.

Japan's JFE Steel has continued to produce a large amount of electrical steel. JFE Steel said that the new production line of its warehouse steel plant will be put into production in the first half of fiscal year 2024, when the output of non-oriented electrical steel will double. JFE officials said that they also planned to invest 50 billion yen in 2026 to further improve the electrical steel capacity of the warehouse steel plant.

Faster-than-expected economic restart boosted iron ore prices. Goldman Sachs said that the latest rise in iron ore prices was mainly driven by dealers' repositioning for the faster than expected speed of China's economic restart. Goldman Sachs also said that traders should be prepared for the surge in iron ore prices in the second quarter of 2023.

Anglo American's high-quality iron ore in South Africa increased significantly. Kunba Iron Mine, a subsidiary of Anglo American's South African iron ore company, said that the railway and port bottlenecks hindered the transportation of iron ore, resulting in a substantial increase in the company's high-quality iron ore inventory. As of December 31, the iron ore inventory has increased from 6.1 million tons in the same period last year to 7.8 million tons.

BHP Billiton is optimistic about the outlook for commodity demand. BHP Billiton said that although its profit in the first half of fiscal year 2023 (as of the end of December 2022) was lower than expected, it was optimistic about the demand outlook in fiscal year 2024.

FMG accelerated the promotion of the Belinga iron ore project in Gabon. FMG Group and the Gabonese Republic have signed the mining convention for the Belinga iron ore project in Gabon. According to the Convention, the Belinga Project will start mining in the second half of 2023 and is expected to become one of the largest iron ore production centers in the world.

Nippon Iron will invest heavily in Canadian mining enterprises. Nippon Iron said that it would invest 110 billion yen (about 5.6 billion yuan) in Canadian raw coal mining enterprises to obtain 10% of common shares. At the same time, implement and reduce carbon dioxide emissions during ironmaking with the rights and interests of high-quality raw coal.

The target cost of Rio Tinto iron ore is US $21.0-22.5/wet ton. Rio Tinto released its financial performance report for 2022, saying that Rio Tinto Group's profit before interest, tax, depreciation and amortization in 2022 was USD 26.3 billion, down 30% year on year; The guiding target of iron ore production in 2023 is 320-335 million tons, and the guiding target of unit cash cost of iron ore is 21.0-22.5 dollars/wet ton.

South Korea set up a low-carbon fund to help the domestic steel industry decarbonize. The Ministry of Trade, Industry and Energy of the Republic of Korea said that it would set up a fund of 150 billion won (about 116.9 million US dollars) to support domestic steel manufacturers in decarbonization during steel production.

Vale supports the establishment of a low-carbon and hydrogen metallurgy laboratory at Central South University. Vale said it would donate $5.81 million to support the new low carbon and hydrogen metallurgy laboratory ("the new laboratory") of Central South University. The new laboratory is expected to be put into use in the second half of 2023, and will be open to all scientific researchers in the mining and steel industries.

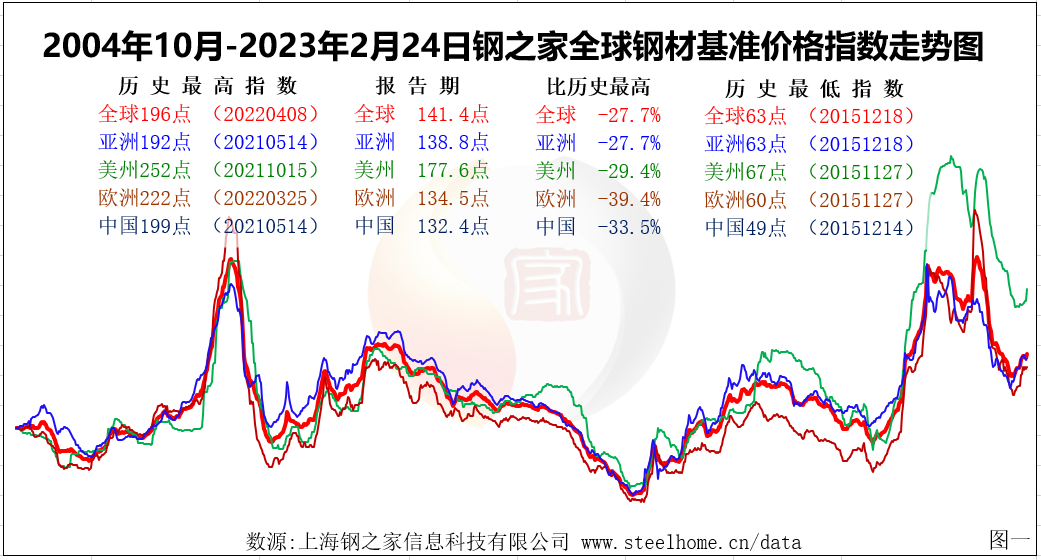

Asian steel market: stable and rising. The benchmark steel price index of Steel House at 138.8 points in the region rose 0.4% month-on-month (YoY), 0.6% month-on-month (YoY) and 16.6% month-on-month (YoY). (See Figure 2)

In terms of flat materials, the market price is obviously rising. In India, ArcelorMittal Nippon Steel India (AM/NS India) and JSW Steel both raised the price of hot coil and cold coil by INR 500/ton (US $6/ton), which took effect on February 20 and February 22, respectively. After price adjustment, the price of hot roll (2.5-8mm, IS 2062) is 60000 rupees/ton ($724/ton) EXY Mumbai, cold roll (0.9mm, IS 513 Gr O) is 67000 rupees/ton ($809/ton) EXY Mumbai, and medium plate (E250, 20-40mm) is 67500 rupees/ton ($817/ton) EXY Mumbai, all of which do not include 18% GST. In Vietnam, the import price of hot coil is 670-685 US dollars/ton (CFR), which is the same as the previous price. Hejing Iron and Steel announced to increase the domestic hot coil price for the delivery period in April by $60/ton. After the price adjustment, the specific price is: descaling SAE1006 hot coil $699/ton (CIF), non-descaling SAE1006 hot coil and SS400 hot coil $694/ton (CIF). In the United Arab Emirates, the evaluation price of hot coil imports is 680-740 US dollars/ton (CFR), which is the same as the previous price. According to market news, China's hot roll is 680-690 dollars/ton (CFR), and India's hot roll is 720-750 dollars/ton (CFR). The import price of cold coil in the United Arab Emirates was 740-760 US dollars/ton (CFR), up 10-40 US dollars/ton. The import price of hot-dip galvanized sheet is 870-960 US dollars/ton (CFR), which is the same as the previous price. In late February, the average export price of China's SS400 3-12mm hot rolled coil was 650 US dollars/ton (FOB), up 15 US dollars/ton from the previous price. The average export price of SPCC 1.0mm cold rolled sheet and coil was 705 dollars/ton (FOB), up 5 dollars/ton. DX51D+Z 1.0mm hot-dip galvanized coil was 775 US dollars/ton (FOB), up 10 US dollars/ton.

In terms of long timber: the market price is stable and rising. In the United Arab Emirates, the import price of rebar is 622-641 US dollars per ton (CFR), which is the same as the previous price. The UAE square billet import price is 590-595 US dollars/ton (CFR), which is also the same as the previous price. According to the news, at present, the UAE Steel Mill has a good hand order for rebar, and overseas billet suppliers are waiting for the latest quotation of UAE Steel Mill for rebar. In Japan, Tokyo Iron and Steel said that due to the tight supply in the market, its bar (including steel bar) price will increase by 3% in March. After the price increase, the price of reinforcement will increase from 97000 yen/ton to 100000 yen/ton (about 5110 yuan/ton), and the price of other products will remain unchanged. Some analysts said that due to the launch of many reconstruction projects, manufacturing-related investments and other large-scale projects, Japan's construction demand is expected to remain strong in the early spring and beyond. In Singapore, the import price of deformed steel bars is 650-660 US dollars per ton (CFR), up 10 US dollars per ton from the previous price. In Taiwan, China, China Steel Group raised the price of medium and heavy plates and hot rolled coils delivered in March by NT $900-1200/ton (US $30-39.5/ton), and the price of cold rolled coils and hot galvanized coils by NT $600-1000/ton (US $20-33/ton). Relevant people said that the price increase was mainly due to the continuous rise of raw material prices, especially the increase of iron ore from US $2.75 to US $128.75 per ton (CFR) in a month, and the increase of Australian coking coal from US $80 per ton to US $405 per ton (FOB), so the price increase was necessary. In late February, the average export price of China's B500 12-25mm deformed steel bars was 625 US dollars/ton (FOB), up 5 US dollars/ton from the previous price.

Trade relations. On February 13, the Indonesian Anti-dumping Commission said that it would review the expiration of the anti-dumping duty on H-beams and I-beams originating from China.

Brief survey: according to the operation situation and the basic situation, the Asian steel market in March may continue to fluctuate and rise.

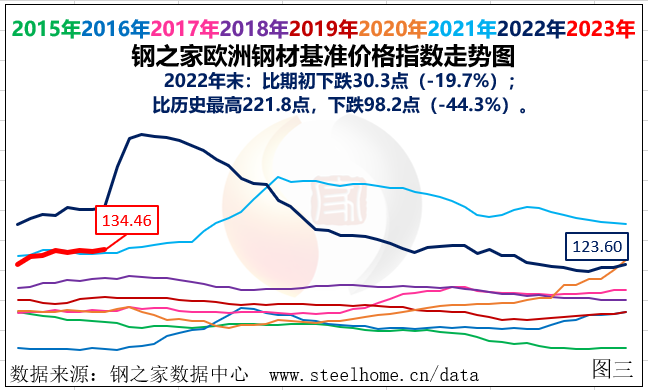

European steel market: continued to rise. The benchmark steel price index of Steel House at 134.5 points in the region rose 0.8% (from decline to rise) on a month-on-month basis, 3% (from convergence) on a month-on-month basis, and 18.8% (from expansion) on a month-on-month basis. (See Figure 3)

In terms of flat materials, the market price rose more than fell. In Northern Europe, the ex-factory price of hot rolled steel coil is 840 dollars/ton, up 20 dollars/ton from the previous price. The ex-factory price of cold rolled sheet and coil is 950 US dollars/ton, which is the same as the previous price. Galvanized sheet is 955 dollars/ton, down 10 dollars/ton from the previous price. According to market news, the ex-factory price of hot coil of Nordic Steel Plant in April and May is 800-820 euros/ton, which has been increased by 30 euros/ton compared with the current price, but the psychological price of buyers is only 760-770 euros/ton. Some steel mills said that the orders for hot coil in April delivery period were full. Market participants expect that the price of hot coil in Europe will rise slightly in March. The reason is that the orders of hot coil in European steel mills are generally good, and they believe that buyers will have replenishment demand in March, and steel mills are willing to increase prices. However, some people said that the terminal demand did not improve significantly, and there was no reason for the price to rise significantly. In southern Europe, the ex-factory price of Italian hot rolls was 769.4 euros/ton, up 11.9 euros/ton from the previous price. The ex-factory price of hot coil with the delivery date of Italian steel mill in May is 780-800 euros/ton, which is equivalent to the arrival price of 800-820 euros/ton, up 20 euros/ton. Some steel mills said that the hot coil orders of some pipe manufacturers in April delivery period were very good, and the market continued to be optimistic. In the CIS, the export price of hot coil is 670-720 US dollars/ton (FOB, Black Sea), which is 30 US dollars/ton higher than the previous price (FOB, Black Sea). The export price of cold coil was 780-820 US dollars/ton (FOB, Black Sea), which also increased by 30 US dollars/ton (FOB, Black Sea). In Türkiye, the import price of hot coil is 690-750 dollars/ton (CFR), up 10-40 dollars/ton. The mainstream export price of hot coils from China to Türkiye in April is 700-710 US dollars/ton (CFR). In addition, ArcelorMittal announced that it had adjusted the price of plate and coil products in five European regions in May to 20 euros/ton, and the new price was specifically: 820 euros/ton for hot rolled plate and coil; 920 euros/ton for cold rolled sheet and coil; The hot-dip galvanized steel coil is 940 euros/ton, and the above prices are the arrival price. There are industry expectations. Other steel mills in Europe will also follow up with the price increase.

Long timber: market prices continue to rise. In Northern Europe, the ex-factory price of deformed steel bars is 765 dollars/ton, which is the same as the previous price. In Türkiye, the export price of deformed steel bars is 740-755 dollars/ton (FOB), which is 50-55 dollars/ton higher than the previous price. The export price of wire rod (low carbon network grade) was 750-780 US dollars per ton (FOB), up 30-50 US dollars per ton. It is reported that the main reason for steel mills to increase the export price of long products is that the reconstruction of the disaster area after the earthquake will inevitably boost the domestic demand for long products, and will also drive up the price. In fact, after the earthquake, Türkiye's steel mills generally raised their domestic rebar quotations: the domestic factory price of rebar was 885-900 dollars/ton, up 42-48 dollars/ton; The domestic ex-factory price of wire rod was 911-953 dollars/ton, up 51-58 dollars/ton.

Brief survey: according to the operation situation and the basic situation, the European steel market in March may continue to fluctuate and rise.

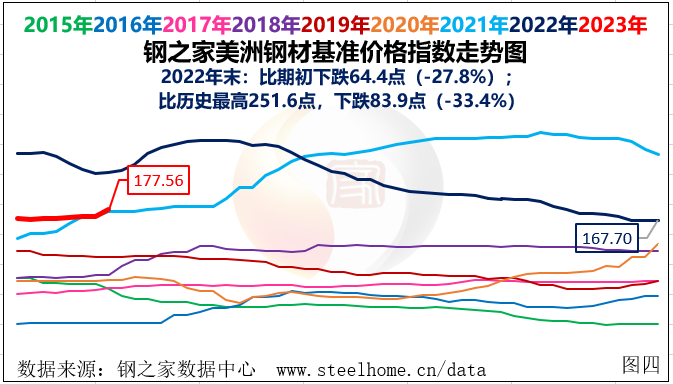

American steel market: sharply increased. The benchmark steel price index of Steel House at 177.6 points in the region rose 3.7% month-on-week (YoY), 2% month-on-month (YoY), and 21.6% month-on-month (YoY). (See Figure 4)

In terms of flat materials, the market price has risen sharply. In the United States, the ex-factory price of hot rolled sheet and coil is 1051 US dollars/ton, up 114 US dollars/ton from the previous price. The ex-factory price of cold rolled sheet and coil was 1145 US dollars/ton, up 100 US dollars/ton. Medium and heavy plate is 1590 US dollars/ton, which is the same as the previous price. Hot galvanizing was 1205 US dollars/ton, up 80 US dollars/ton. Following the increase in the base price of plate products by US $50/short ton (US $55.13/ton) by Cleveland - Cleves, NLMK's US subsidiary also announced an increase in the base price of hot coil by US $50/short ton. Some market insiders said that the hot coil orders received by most American steel mills in April and May are quite good, and the inventory in the factory is also declining, so the willingness to continue to increase prices is strong. In South America, the import price of hot coil is 690-730 US dollars/ton (CFR), which is 5 US dollars/ton higher than the previous price. The main export quotation from China's hot roll to the Pacific coastal countries in South America is 690-710 US dollars/ton (CFR). Import quotation of other types of plates in South America: cold coil 730-770 US dollars/ton (CFR), up 10-20 US dollars/ton; Hot-dip galvanized sheet is 800-840 US dollars/ton (CFR), aluminum-zinc sheet is 900-940 US dollars/ton (CFR), and medium-thick plate is 720-740 US dollars/ton (CFR), which are roughly the same as the previous price.

Long timber: the market price is generally stable. In the United States, the ex-factory price of deformed steel bars is $995/ton, which is roughly the same as the previous price. The import price of deformed steel bar is 965 US dollars/ton (CIF), the wire rod for network is 1160 US dollars/ton (CIF), and the small section steel is 1050 US dollars/ton (CIF), which is roughly the same as the previous price.

Trade relations. The United States Department of Commerce announced that it had decided to impose countervailing duties on fixed-size plates in China and South Korea and maintain the countervailing duty rates of 251% and 4.31%, which would take effect on February 15, 2023.

Brief survey: according to the operation situation and the basic situation, the American steel market may continue to be strong in March.